Corn and soybean global outlook: what is expected for 2031?

In a recent IEC member-exclusive presentation, Adolfo Fontes, Global Business Intelligence Manager at DSM Animal Nutrition and Health, gave an informative insight into the future global trends in corn and soybean production.

In a recent IEC member-exclusive presentation, Adolfo Fontes, Global Business Intelligence Manager at DSM Animal Nutrition and Health, gave an informative insight into the future global trends in corn and soybean production.

He began by highlighting that over the next 2-3 years, a range of uncertainties will impact agriculture, including:

- Geopolitical stability

- Crop profitability and energy crisis

- Climate change

- Covid 19 and inflation

Looking further ahead to the next ten years, he suggests that world population growth will significantly impact agriculture due to an expected increase in demand for animal protein. It is predicted that by 2031, an additional 71 million tons of animal protein will be needed globally. The latest figures (2021) demonstrate that 92 million tons of eggs are produced worldwide – this is expected to increase by 15% over the next ten years. Thus, eggs can be a great solution to meeting the protein demands of the future.

“If we see more money in the pockets of the population, we will see an increase in animal protein production”, Adolfo predicted.

To supply animal protein to the population, the demand for grains and oilseed will increase; thus, it is important to review production and consumption trends in different regions globally.

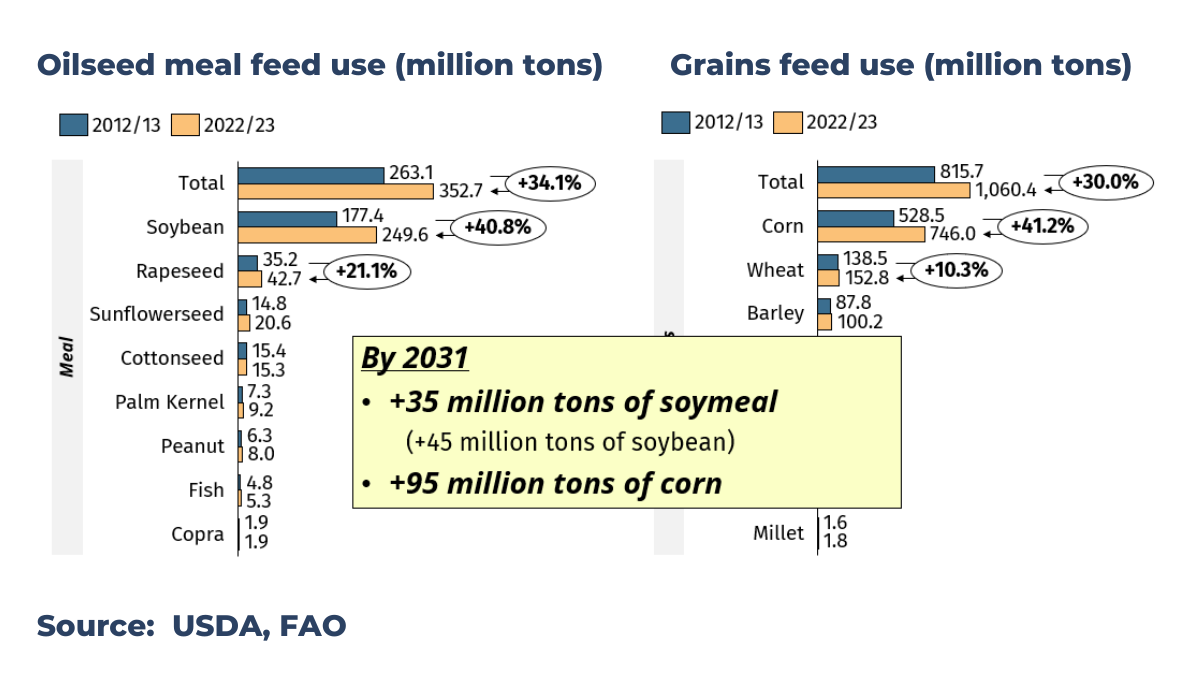

Grain and oilseed use over the last 10 years

Over the last decade, grain feed use has increased by 30%, with corn representing 70% of these grains. In the same period, oilseed meal feed use has increased by just over 34%, with 70% of this feed being soybean. With the increase in demand for animal protein in 2031, we will need an additional 45 million tons of soybeans to be able to produce 35 million tonnes of soymeal and a further 95 million tons of corn.

Corn overview

While overall corn production increased from 2001 to 2022, from 571 million tons to 1,161 million tons, the rate of this increase has slowed with a 34.2% increase witnessed from 2011 to 2021, in contrast with a 51.3% increase from 2001 to 2011.

The most significant increase in corn production over the past ten years globally has been witnessed in Argentina (over 150%). However, the USA still maintains its place as the largest corn producer in the world, producing 384 million tonnes of corn in 2021/2022. China is the second largest producer, having seen an increase in production of 2.9% over the last decade. Adolfo highlights that while China produces 23.5% of the world’s corn, it still needs to import, with consumption of 26.9%.

Corn projections

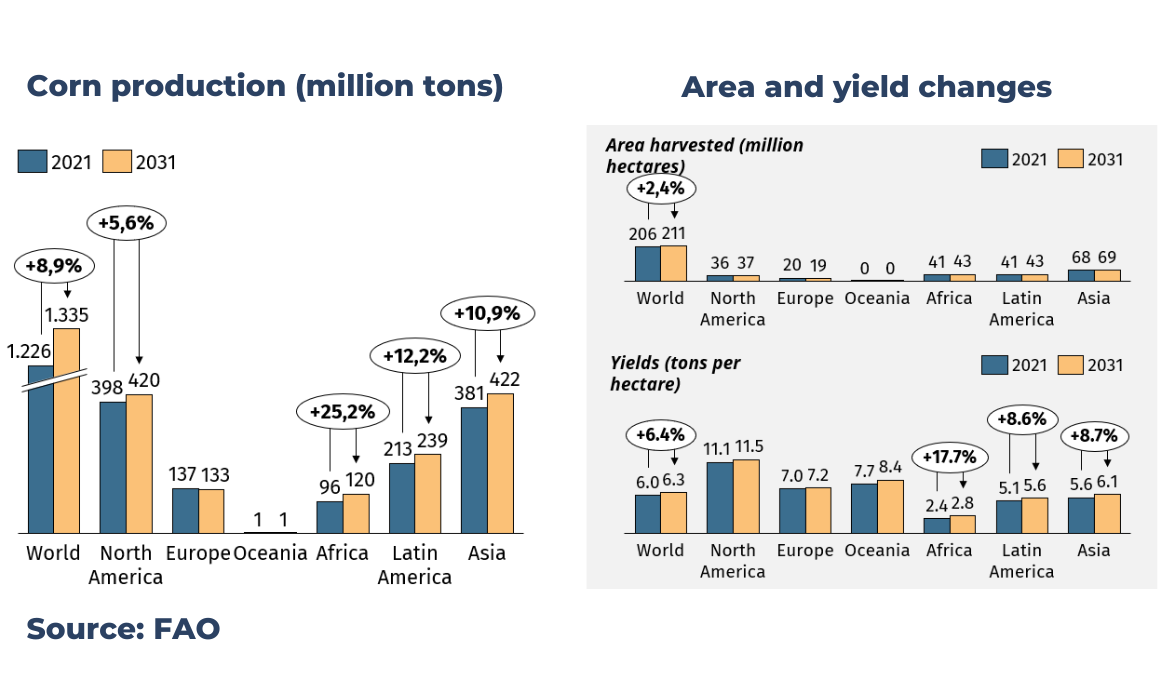

Global corn production is projected to increase by around 9% in the next decade – this is a decrease in production rate compared to the 34% increase over the past ten years. Africa is expected to have the greatest percentage increase in production at 25%.

Yields are improving worldwide, with a global increase of 6.4% expected by 2031. This is particularly notable in Africa, Latin America and Asia, with increases of 17.7%, 8.6% and 8.7%, respectively.

The total harvested area for corn production is predicted to reach 211

In terms of regions, North America and Asia are expected to continue to lead corn production in 2031 with respect to million tons of corn produced.

Soybean overview

Overall, from 2001 to 2022, global soybean production has increased at an accelerating rate, with a 46.9% increase in production seen in just the last ten years compared to a 30% increase in the first decade of this century. From 2012 to 2022, Brazil witnessed a nearly 90% increase in production, overtaking the USA to become the largest producer of soybeans globally, representing 36.2% of production in 2021/2022 with 126 million tons. The US is now the second largest producer, with 121 million tons in 2022.

Imports of soybean in China are high, with this nation representing only 4.7% of production whilst consuming 31% of the world’s share. In contrast, the US is producing 34.7% but consuming 18.4%.

Soybean projections

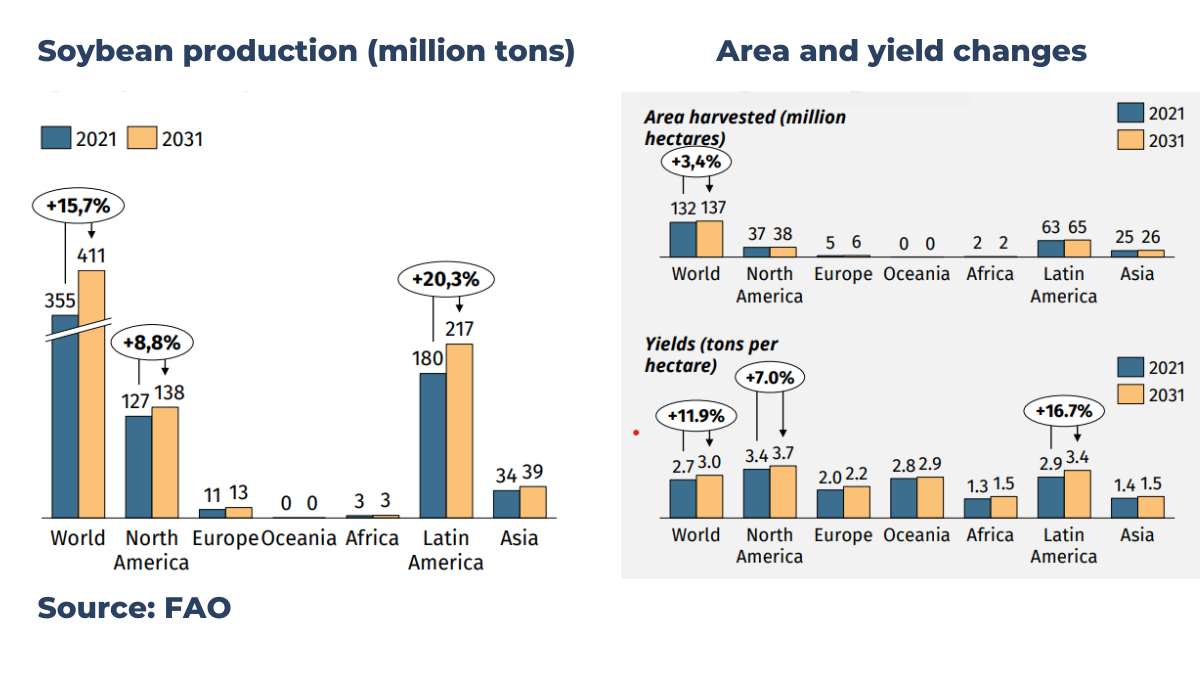

From 2021 to 2031, soybean production is expected to increase globally by 15.7%, a deceleration from the previous ten years’ 47% increase.

Soybean production is dominated by the Americas, with Latin America projected to lead in 2031 at 217 tons (an increase of 20%) and North America second at 138 million tons after a 9% increase over the decade. It is predicted that overall, Latin America will be responsible for nearly 40 million tons of additional soybeans over the next ten years.

Average soybean yield will also increase by 12% worldwide, with Latin America alone seeing an increase in yield of 17%.

So…where will our corn and soybean come from over the next 10 years?

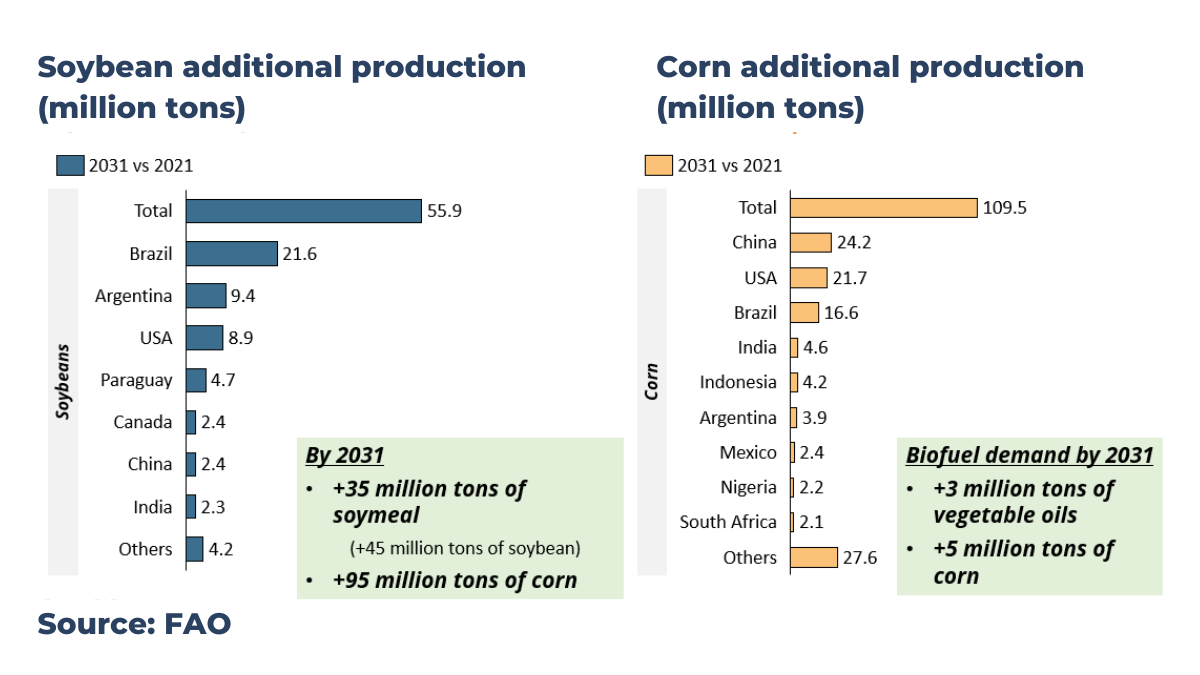

Overall, an additional 55.9 million tons of soybean is projected to be produced over the next ten years – 21.6 mil tons of this will come from Brazil, with 9.4 and 8.9 coming from Argentina and the USA, respectively.

109.5 million tons more corn will be produced over the next decade. China, Brazil and the USA will be the main contributors to this, with an additional 24.2, 21.7 and 16.6 million tons, respectively.

Find out more!

For more information on corn and soybean trends in your region, click the button below to watch Adolfo’s full presentation. Please note that access to this video is for IEC members only.

Click here to watch the full presentation