Grain Price Cycles: Past insights support an optimistic outlook for the egg industry

9 May 2023

During his latest update for the IEC on Tuesday 18 April, Adolfo Fontes, Senior Global Business Intelligence Manager at DSM Animal Nutrition and Health, provided an expert overview of ‘Grain Price Cycles – What Can We Learn From Previous Experiences?’

During his latest update for the IEC on Tuesday 18 April, Adolfo Fontes, Senior Global Business Intelligence Manager at DSM Animal Nutrition and Health, provided an expert overview of ‘Grain Price Cycles – What Can We Learn From Previous Experiences?’

Presenting to a global delegation at the IEC Business Conference in Barcelona, Adolfo gave brief short-term and long-term outlooks, before offering a comprehensive historic analysis of corn, wheat and soybeans, using past examples to offer insights into the future.

Factors affecting the future

To begin his presentation, Adolfo explored the uncertainties in the short-term impacting the egg value chain, analysing the level of impact and predictability.

Referencing global economic challenges, he explained: “Inflation and consumer behaviour are getting more positive if we compare to the past.” He described the economic landscape as “still uncertain, but much less than it was”, in comparison to the end of last year. He was also positive regarding production costs: “Grain prices, energy costs – they have been improving significantly over the last few months.” Using the case study of the Netherlands, Adolfo demonstrated how natural gas prices have begun to reduce significantly, after a peak around September 2022.

Adolfo also highlighted the importance of weather conditions in the grain industry, reflecting on a very challenging few years in South America: “Argentina has been hugely impacted by consecutive years of La Niña weather phenomenon, having a significant impact on global availability of soymeal, given that they are its biggest exporter.” He then went on to explain that the forecast is expected to neutralise, leading to better outcomes for the grain industry. However, a change to El Niño conditions later this year is also possible, which adds some uncertainty to the outlook.

The expert speaker also recognised less optimistic factors: “Of course, disease is very difficult to predict.” Highlighting African swine fever and avian influenza as key concerns, he said: “They will impact not only the animal protein value chain, but also the grain markets.” Finally, he acknowledged geopolitical trends as the “most difficult” to anticipate, whilst emphasising the significant level of impact they have on our value chain.

Looking ahead to the longer-term landscape, Adolfo explained that we can expect “solid growth” in our sector: “Egg production is expected to, and needs to, increase by 14 million tons over the next 10 years to meet global demand.”

Corn, wheat and soybean: Past trends

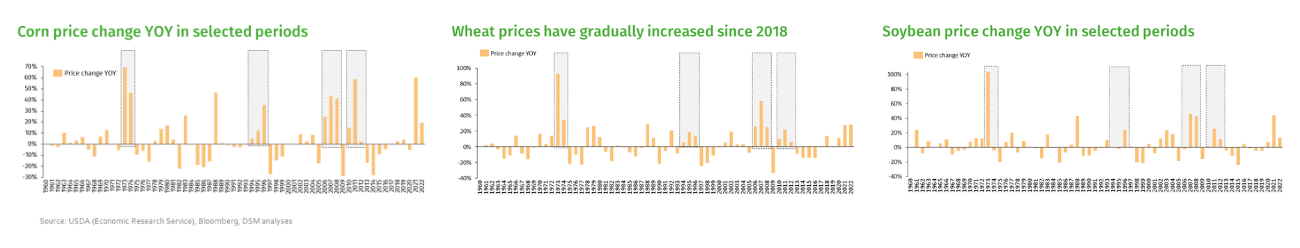

Following this overview, Adolfo conducted an in-depth exploration of year-on-year grain prices. He identified that there are only four periods in the last century, before 2021, which saw record prices of at least two of the three principal field crops, where the price increases were sustained for two or more consecutive years. These were: 1973-74, 1994-95, 2006-08, and 2010-12.

Adolfo then analysed the reasons for the record prices in these years. Factors influencing each period mirrored many of the present-day uncertainties discussed earlier in his presentation, including; weather conditions, economic change, and availability of raw material.

He added that the latest occasion grain prices reached these records for consecutive years was 2021-2022, due to factors including COVID-19 disruptions, the Russian invasion of Ukraine, and extreme weather: “So the perfect storm made it happen again for the fifth time in the last century, two of the three main crops achieving record levels for two or more years.”

Given that each of the historic periods were followed by decline in grain prices, Adolfo indicated that we can expect more stable prices for the next few years following the most recent occurrence of record levels.

An optimistic outlook

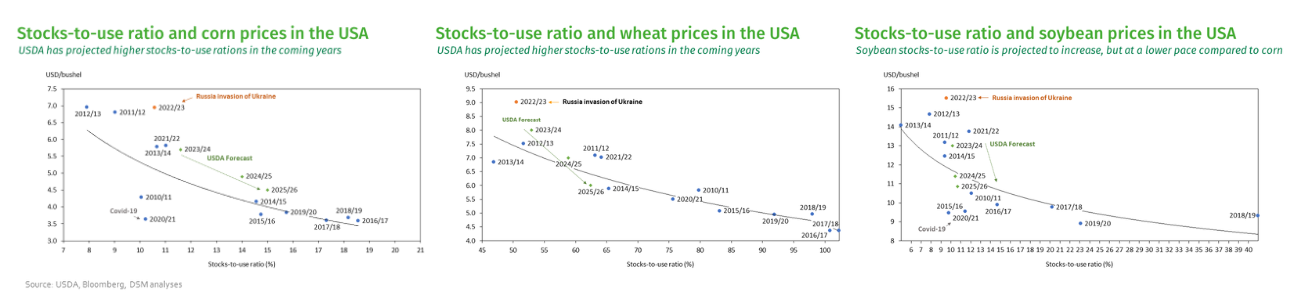

Adolfo also studied the correlation between stocks-to-use ratio and prices for corn, wheat and soybean. He argued that despite some outliers caused by unprecedented events such as the Russian invasion of Ukraine and COVID-19, there is a trend which prices will typically follow. “If you look at the USDA projections for the coming three seasons, we can expect that prices will follow this line, but at a higher level,” he explained. “Which means that prices will probably continue to decline, but stabilising at a higher level – exactly the same as what happened in the 70s, 90s, and the 2000s.”

“I think the current market environment is very different from the past,” he concluded, “but we can be a little bit more positive about grain prices over the next three seasons. It can change, of course, given the situation with the war, given the situation with the weather, but this is the picture that we can draw today.”